Follow ‘MoreLiver’

on Twitter

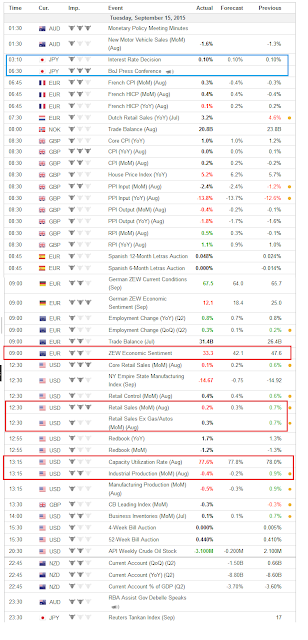

Bank of Japan did nothing. Bad euro area ZEW, US retail sales, industrial production:

EUROPE

UK Economic

Outlook: in good economic shape – Nordea

Finland: Debt

grows while Finland struggles to reform – Danske

Bank

Finland - Concluding

Statement Article IV Consultation – IMF

A

survey-based measure of slack for the euro area – ECB

The

state of the house price cycle in the euro area – ECB

MIGRATION

Migration

into the EU - a first look at the impact – DB

Research

EU

court deals blow to ‘benefits’ migration – Politico

UNITED STATES

FEDERAL RESERVE

RBS: Fed Shouldn't Worry About Losing Credibility: It Already Did – ZH

The Consensus is No Rate Hike this Week – Bill

McBride

Here’s How the Street Views the Fed’s Delicate Balancing Act – WSJ

Data Dependent? Fed Policy Is Volatility Dependent! – Econmatters

Larry Summers: Here’s yet another reason the Fed shouldn’t raise rates – WaPo

Why the Fed Is Likely to Stand Pat This Week – BB

The economy never seems to be as good as the Fed thinks it will be – WaPo

Will The Fed Jeopardize

Any Of The Three Key Bottoms? – Alpha

Now

August saw the S&P 500 (.SPX), oil (CLc1), and the dollar index

(.DXY) form significant lows. However, Fed action, or lack thereof, could

jeopardize two out of these three key bottoms.

DATA

August Retail Sales Post Small Improvement, But Consumers Still Spooked –

Alpha

Now

US core retail sales have grown quite solidly so far in the third quarter

– Pictet

Retail Sales Disappoints – ZH

Retail Sales increased 0.2% in August – Bill

McBride

Fed: Industrial Production decreased 0.4% in August – Bill

McBride

OTHER

Yield Forecast Update:

Fed hike vs possible further ECB easing – Danske

Bank

BoJ stands pat on policy

for now – more QE possible in October – Nordea

This time, BOJ could

wait and watch before coming to yen’s rescue – Reuters

REGULARS

U.S. Stocks Down,

Traders Sitting Out

Caution Continues to

Dominate

Morning MoneyBeat US – WSJ

The U.S. Appears Headed

for an Earnings Recession

Global Daily – ABN

AMRO

US retail sales show signs of

sustained economic growth…despite turmoil in financial markets * ZEW sentiment

drops, while eurozone labour market continues to improve

BoJ stays put, JPY

strengthening * Yields dragged lower by growing Chinese worries, still waiting

for Thursday * UK inflation in negative territory * EUR falls as stock market weakens

Oil should have got a

fillip from Opec's belief that it is winning its production war with the North

American shale sector, but remains stuck. And yes, the FOMC meeting continues

to dominate the agenda elsewhere.

The situation in

emerging markets continues to be dire as the BRICS countries struggle with

falling equities, declining inflation and staggering debt obligations.

EU member states fail to

agree on binding refugee quotas as German Interior Minister suggests cutting EU

funding to those countries not doing enough * ECJ rules member states entitled

to withhold benefits from unemployed EU migrants * French President eyes shake

up in labour market rules * EU extends sanctions on individuals in Ukraine

crisis * EU ministers meet to discuss aid programme for farmers

Schengen split complicates migration

debate — The Corbyn crew — New Brexit balance

US Open – ZH

China Stocks Drop Most

Since Late August, BOJ Disappoints Bailout Addicts; US Futures Flat

Frontrunning – ZH

The FOMC waiting game continues as

AUD saw an active session overnight on political developments while the Bank of

Japan monetary policy statement entirely failed to make an impression. Risk

sentiment remains a bit wobbly, keeping USDJPY near the 120.00 level.

As the wait for

Thursday's Federal reserve policy decision grinds inexorably onwards (and as

journalists the world over run out of synonyms for 'waiting patiently') one

could be forgiven for assuming that the price of everything in every market,

everywhere, hinges on the immediate outcome of this single event. For equities,

however, it's different.

FINNISH

Kehittyvät taloudet hidastuvat uhkaavasti *

Euroalueen teollisuustuotannon kasvu vahvaa * Kiinan teollisuustuotanto

aiheutti pettymyksen * Tänään julkaistaan Britannian inflaatio ja Saksan

ZEW-indeksi

Pentti

Haaparanta: Hypyt on jo hypätty – Akateeminen talousblogi